A new player is emerging in the credit-building arena: positive rent reporting.

The Benefits of Positive Rent Reporting

In today’s financial landscape, a good credit score is more important than ever. It can influence everything from loan approvals to interest rates and even job opportunities. Traditionally, credit scores have been built through credit card usage, loan repayments, and other forms of debt. However, a new player is emerging in the credit-building arena: positive rent reporting.

What is Positive Rent Reporting?

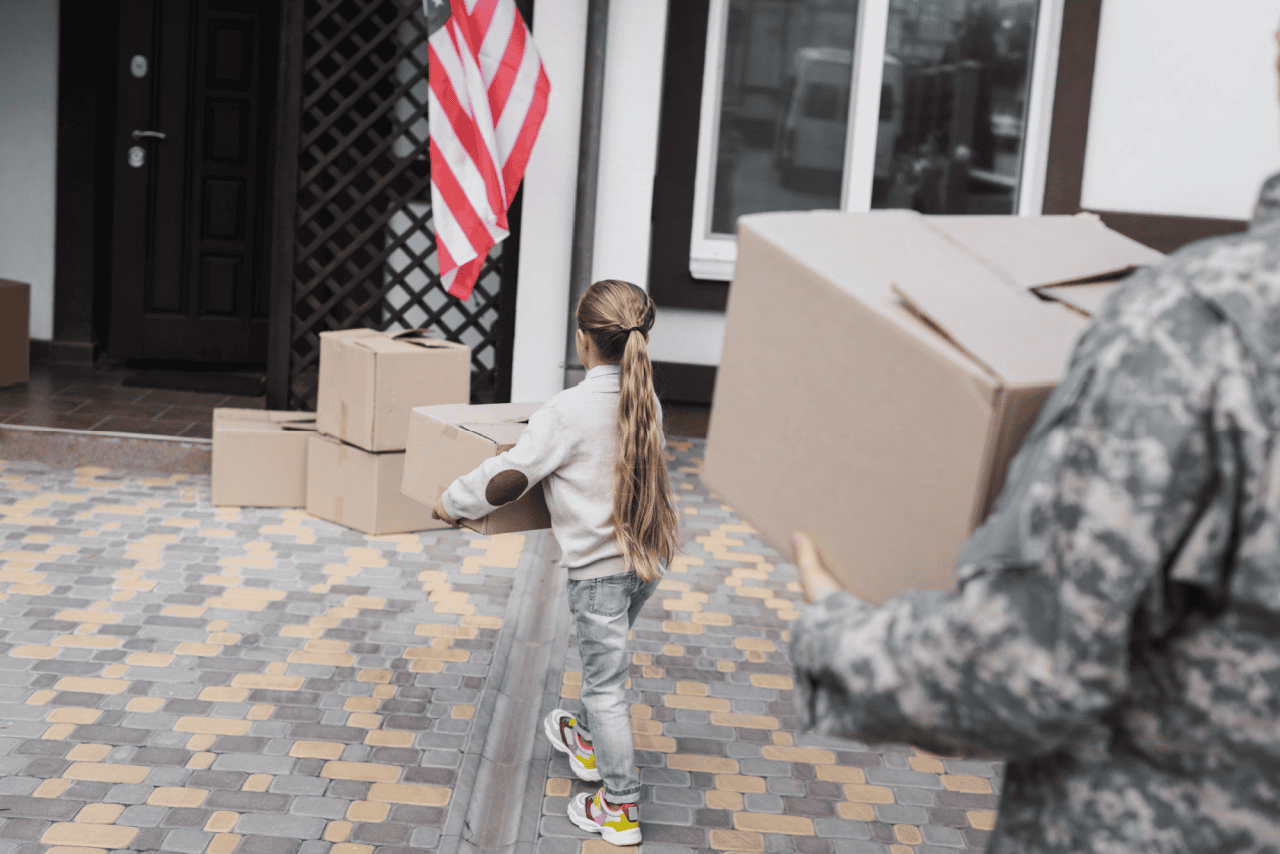

Positive rent reporting is the practice of submitting renters’ monthly on-time payments to credit bureaus. This information is then included in the calculation of a consumer’s credit score. Unlike traditional methods of building credit, which often require taking on debt, positive rent reporting allows renters to build their credit simply by paying their rent on time.

How Does It Work?

When a renter pays their rent on time, their landlord or a third-party service reports this information to one or more of the major credit bureaus. These bureaus then include the renter’s payment history in their credit report, which can positively impact their credit score.

Screen Your Tenant Today!

Gain peace of mind with AAOA’s credit, criminal, and eviction reports.

The Benefits of Positive Rent Reporting for Renters:

- Renters who are currently credit invisible can establish credit scores and those with existing records can improve their scores.

- A stronger credit score may enable renters to access financing with lower interest rates, avoid unbreakable debt traps, and increase access to mortgages.

- Only on-time rental payments are reported to the credit bureaus; renters are automatically unenrolled upon a late or missed payment.

The Benefits of Positive Rent Reporting for Borrowers:

- One year of credit-reporting services at significantly discounted or no cost.

- Enhanced marketability and reduced turnover.

- Improved net operating income through more stable collections and lower turnover.

- 73% of renters are more inclined to pay rent on time when their rental payments are reported

Positive rent reporting is a powerful tool that can help renters build their credit scores. By simply paying their rent on time each month, renters can improve their financial standing and open new opportunities.

Source: Berkadia

Accessibility

Accessibility