Multifamily properties are a popular type of real estate investment

Finding the Perfect Multifamily Property

Because of their capacity to improve an investor’s cash flow, generate multiple streams of income and boost their net operating income (NOI), multifamily properties are a popular type of real estate investment. Multifamily refers to properties, such as apartment complexes, condominiums, townhouses, semi-detached units and duplexes, all of which offer multiple spaces for rent.

Are you taking that big step and purchasing your first multifamily property? Or are you an old pro adding another investment property to your real estate portfolio? Either way, there are certain steps that you need to follow to make the experience a successful one.

Taking your time and doing your due diligence when considering a particular investment property will always be a crucial step. In the end, it can help you capture the perfect property with excellent ROI potential or it can save you from a drastic mistake.

When buying a rental property, there are local price trends, zoning rules and vacancy rates to consider in addition to financing and renovation costs. It is recommended that you to guide you through the bewildering process.

Below are some very important steps to take when choosing your next investment property.

· Consult with a real estate agent

Find a realtor who specializes in the acquisition and disposition of multifamily assets in your target area. In addition to providing you with valuable insights and potential deals, they will help you through the entire sales process, including the offer and negotiating steps.

· Location

This is the most crucial factor when judging a possible multifamily purchase as it significantly impacts rental demand and property value. Consider the building’s proximity to amenities, public transportation, employment centers and whether there are any environmental concerns.

Analyze the neighborhood’s growth potential, property valuations, rental demand, crime rate and school district ratings as well as future development plans. These factors can affect a property’s value and its appeal to tenants. Remember, a prime location can attract quality renters while also ensuring consistent rental demand and profitability.

Get started by viewing .

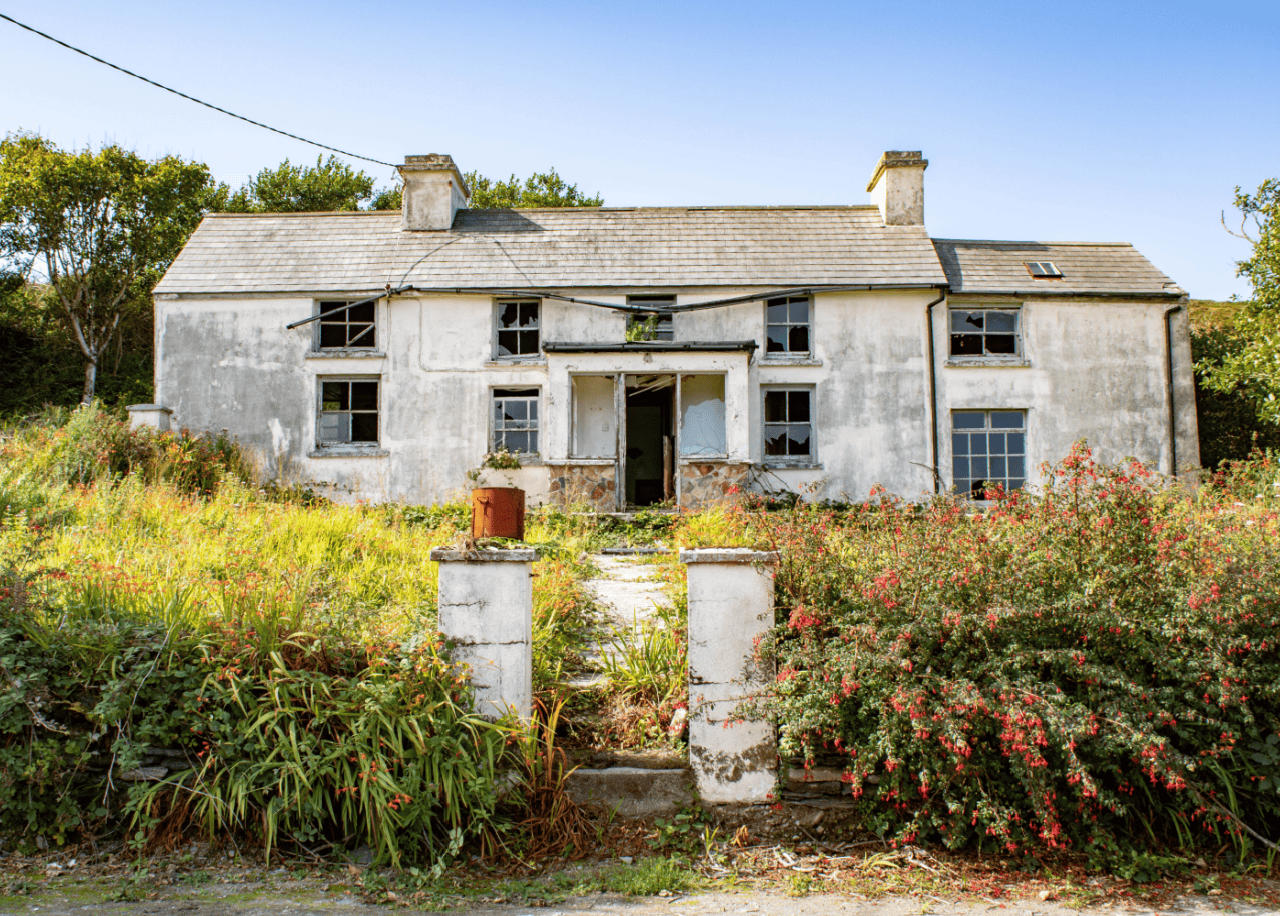

· Property condition

Assess the overall condition of the building, including structural integrity, plumbing and electrical systems. What is the condition of the building’s individual units? Check for mold, fire/water damage, windows, insulation, piping and wiring. How old are the heating and air conditioning units? If the building requires immediate repairs, you should factor them into the purchase price. A property’s sales history could indicate possible red flags.

· Rental income potential

Purchasing a multifamily property often leads to a far better return on real estate investment (ROI) than other passive forms of investing. When purchasing a multifamily property, analyze current market rents in the area and estimate the potential rental income from each unit to calculate the property’s potential cash flow.

Your rental income, operating costs and the amount of your mortgage loan are factors that influence your ROI. Operating costs can consist of property taxes, real estate agent fees, utilities, maintenance, property management fees, homeowners insurance and legal fees.

To calculate your ROI for a multifamily rental property and its profitability, consider using the formula:

ROI = (Annual Rental Income − Annual Operating Costs) ∕ Mortgage Value.

· Vacancy rates

Before you purchase a multifamily property, be sure to investigate the current vacancy rate in the building and the surrounding area to assess tenant turnover and potential rental income stability. Multifamily homes by definition have multiple units and therefore, separate income sources. That means that if one tenant moves out, you will still receive income from the other tenants.

· Financing options

One thing to know about multifamily homes is that they have different mortgage requirements depending on the type of multifamily and what it’s being used for. After you find the right property, explore different financing options available based on your financial situation and the property’s value.

According to Kaj Lea, head of the Pacific Northwest and Central Region, J.P. Morgan Chase Commercial Term Lending, “Successful real estate investing isn’t just about choosing the best property; it’s also about securing the best possible interest rate and managing cash flow.” Be aware of the down payment requirements and interest rates of conventional, commercial, FHA and VA loans, as they may vary depending on the size of the property.

“Make sure you understand the historical actuals on the expense structure, not just what the broker estimates they could be,” Lea said. “Each building is a little different based on its physical features and mechanical systems.”

Get a Free Multifamily Loan Quote

Access Non-Recourse, 10+ Year Fixed, 30-Year Amortization

Secure the funding you need to acquire, construction, or refinance an investment property. AAOA’s network of expert lenders offer a wide range of loan options to help you achieve your goals!

· Zoning and legal issues

Verify the property’s compliance with local multifamily zoning laws, rent control, insurance requirements and any upcoming legislation that may impact your purchase and expected returns. Ensure that the property complies with all local codes and zoning restrictions.

· Property management

Consider the management demands of the property and whether you have the time and energy to deal with them yourself. Management of a multifamily property involves time and effort, including maintenance, tenant-related issues, marketing vacant units, tenant screening and numerous other administrative tasks. You’ll need to attract and retain quality tenants, establish rent collection processes, conduct regular maintenance and repairs and ensure compliance with local regulations. If all of this is too much for you, you may need to hire a professional property management company.

A property manager will handle day-to-day operations, tenant background checks, rent collection, and property maintenance. They will help optimize your rental income, minimize vacancies and ensure the long-term success of your investment. If you expect to hire a property management company, you’ll need to factor that cost into your budget.

· Property inspection

Hire a professional inspector to examine the building’s structural integrity, plumbing, electrical systems and the state of the individual units. They should assess the building’s condition and provide you with a detailed list of any significant repair needs and their probable cost.

· Review financial statements

The seller should provide you with detailed financial information, including income and expense records, to verify the property’s profitability. The cap rate (net operating income divided by purchase price) evaluates the yield of a property over one year. The higher the cap rate, the greater your risk and return—and the greater impact on your bottom line. Compare the property’s cap rate to other properties in the market to assess the property’s potential return on investment.

· Take out landlord insurance

A landlord insurance policy is meant to protect you as an investment property owner while safeguarding your rental properties. It is extremely important for any residential investor to protect themself with high quality landlord insurance from a reputable company. One can never overestimate the benefits and importance of excellent insurance coverage.

Although it is not mandatory that rental owners purchase landlord insurance, most lenders will require it if you are financing the property or hold a mortgage on it.

· Make an offer and close

Your real estate agent will submit your offer and negotiate with the seller or their agent. The agent’s negotiating skills can assist you in securing a favorable deal and maximize your investment potential. After you and the seller agree upon a price, you will hire professionals, such as property inspectors and real estate attorneys, to conduct thorough inspections and provide legal guidance. Once they have given you the green light, you can proceed with the closing process, including the transfer of funds and finalization of financing arrangements.

Congratulations, you are now a landlord, the owner of a great rental property.

As the nation’s largest landlord organization (with more than 150,000 members nationwide), the American Apartment Owners Association (AAOA) offers an innovative approach to managing properties. For 20 years, we have provided an online network of resources and benefits for landlords to make property management more convenient, including extensive tenant screening, credit checks, landlord forms, rental applications, and real estate updates.

Disclaimer: All content provided here-in is subject to AAOA’s Terms of Use. Nothing contained on this website constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. AAOA recommends you consult with a financial advisor, tax specialist, attorney or other specialist who is able to properly advise you.

Accessibility

Accessibility